As an example, if a residential or commercial property has a worth of $200,000 and the insurance coverage provider needs an 80% coinsurance, the owner must have $160,000 how can i get rid of my timeshare legally of home insurance coverage. Owners might consist of a waiver of coinsurance provision in policies. A waiver of coinsurance clause gives up the homeowner's requirement to pay coinsurance.

In many cases, nevertheless, policies might include a waiver of coinsurance in the occasion of a total loss. Coinsurance is the quantity an insured must pay against a medical insurance claim after their deductible is satisfied. Coinsurance also uses to the level of home insurance coverage that an owner need to buy on a structure for the coverage of claims.

Both copay and coinsurance arrangements are methods for insurer to spread risk among the individuals it guarantees. Nevertheless, both have benefits and drawbacks for customers.

Many or all of the items included here are from our partners who compensate us. This might affect which items we discuss and where and how the item appears on a page. However, this does not affect our assessments. Our viewpoints are our own. Health insurance coverage differs from any other insurance you purchase: Even after you pay premiums, there are complex out-of-pocket expenses like deductibles, copays and coinsurance.

It is essential to comprehend the essentials of medical insurance so you can make the best financial decisions for your household prior to you require care. how to get therapy without insurance. That way, you can focus more on recovery when the time comes. Here's our guide on how the expenses of health insurance work. Prior to you understand how it all interact, let's brush up on some common medical insurance terms.

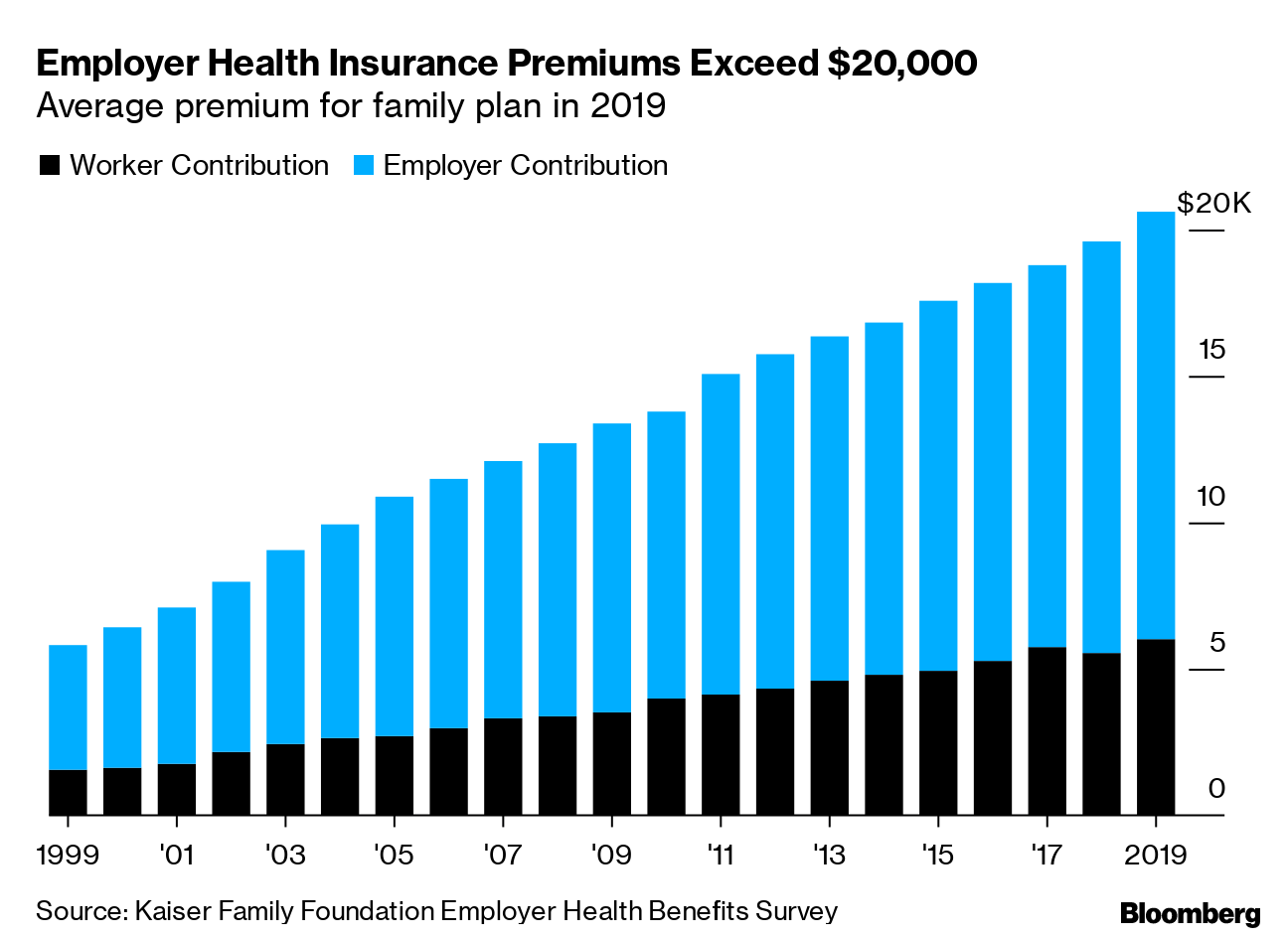

Like a health club subscription, you pay the premium each month, even if you don't use it, otherwise lose protection. If you're fortunate adequate to have employer-provided insurance, the business usually selects up part of the premium. A predetermined rate you pay for health care services at the time of care.

The deductible is just how much you pay prior to your health insurance begins to cover a larger portion of your expenses. In general, if you have a $1,000 deductible, you need to pay $1,000 for your own care out-of-pocket before your insurance provider begins covering a higher part of costs. The deductible resets yearly.

The smart Trick of How Much Does Long Term Care Insurance Cost That Nobody is Talking About

For example, if you have a 20% coinsurance, you pay 20% of each medical bill, and your medical insurance will cover 80%. The most you could need to pay in one year, out of pocket, for your health care before your insurance coverage covers 100% of the bill. Here how to legally get out of bluegreen timeshare you can see the optimums permitted by the government for private strategies for this year.

Some policies have low premiums and high deductibles and out-of-pocket maximum limitations, while others have high month-to-month rates and lower deductibles and out-of-pocket limits. In general, it works like this: You pay a regular monthly premium simply to have medical insurance (what is a deductible for health insurance). When you go to the physician or the healthcare facility, you pay either full cost for the services, or copays as detailed in your policy.

The staying percentage that you pay is called coinsurance. You'll continue to pay copays or coinsurance till you have actually reached the out-of-pocket optimum for your policy. At that time, your insurer will start paying 100% of your medical bills until the policy year ends or you switch insurance plans, whichever is initially.

If you utilize an out-of-network medical professional, you might be on the hook for the entire costs, depending on which kind of policy you have. This brings us to three new, related meanings to comprehend: The group of medical professionals and service providers who accept accept your medical insurance. Health insurance providers work out lower rates for care with the medical professionals, hospitals and centers that are in their networks.

If you get care from an out-of-network service provider, you may have to pay the entire costs yourself, or simply a part, as suggested in your insurance policy summary. A supplier who has consented to deal with your insurance coverage strategy. When you go in-network, your expenses will generally be cheaper, and the costs will count toward your timeshare compliance deductible and out-of-pocket optimum.

Your expenses would be various based upon your policy, so you'll wish to do your own computations each year when facing a medical expense. Vigilance is single and has an annual deductible of $1,200. Her insurance strategy has some copays, which do not count towards her deductible. After she satisfies the deductible, her insurance company pays 80% of her medical expenses, leaving Vigilance with coinsurance of 20%.

Because she goes to an in-network provider, this is a complimentary preventive care check out. Nevertheless, based on her physical, her medical care doctor thinks Prudence must see a neurologist, and the neurologist suggests an MRI. Copays for an in-network specialist on her plan are $50, which she must pay, while her insurance provider will cover the remainder of the neurologist's fee.

Getting My What Is A Deductible For Health Insurance To Work

Imaging scans like this are "based on deductible" under Prudence's policy, so she should pay for it herself, or out-of-pocket, because she hasn't satisfied her deductible yet. So her insurer won't pay anything to the MRI center. $50 for the neurologist copay + $1,000 for the scan = $1,050. Later on in the year, Vigilance falls while treking and injures her wrist.

After the copay, ER charges were $3,400. Her deductible will be used next. Vigilance paid $1,000 of her $1,200 deductible earlier in the year for her MRI, so she is accountable for $200 of the ER bill before her insurer pays a larger share. After deductible and copay, the ER charges overall $3,200.

$ 100 for the ER copay + $200 for staying deductible + 20% coinsurance ($ 640) = $940. Vigilance has actually now paid $1,990 towards her medical costs this year, not including premiums. She has actually likewise fulfilled her annual deductible, so if she needs care again, she'll pay just copays and 20% of her medical costs (coinsurance) till she reaches the out-of-pocket maximum on her strategy.

Understanding healthcare can be confusing. That's why it's handy to understand the significance of commonly utilized terms such as copays, deductibles, and coinsurance. Knowing these essential terms might help you comprehend when and just how much you need to spend for your health care. Let's have a look at the meanings for these 3 terms to much better comprehend what they suggest, how they work together, and how they are different.

For instance, if you hurt your back and go see your physician, or you require a refill of your child's asthma medication, the amount you pay for that go to or medicine is your copay. Your copay quantity is printed right on your health insurance ID card. Copays cover your part of the cost of a medical professional's go to or medication.

Not all strategies utilize copays to share in the expense of covered expenses. Or, some plans might utilize both copays and a deductible/coinsurance, depending on the type of covered service. Also, some services might be covered at no out-of-pocket cost to you, such as annual examinations and specific other preventive care services. * A is the quantity you pay each year for the majority of eligible medical services or medications before your health plan begins to share in the expense of covered services. how to get cheap car insurance.